First and Foremost

We hope that this commentary finds you and your loved ones safe and healthy. Bear markets and recessions are typically accompanied by the fear of losing a job, reduced income or watching your investments lose value. This one is particularly serious. Not only do we have to worry about these things, but we also are faced with the fear of becoming critically ill from an invisible virus. We are currently facing challenges that the world has not seen since the Influenza Pandemic of the late 1950’s, or possibly even going back a century to the Spanish flu of 1918. It is a scary time.

Rest assured, the human race is amazingly resilient. We will work together to overcome this, no matter how bad it may get. By no means do we want to downplay the severity of our current state of affairs, but humankind has overcome times like these and we have come out on the other side, stronger.

We have spoken to countless people over the last month and a half. We are learning about stories of tremendous strength and optimism across our network of clients/family/friends (you are all one in the same). We’ve had numerous conversations with doctors, nurses, mail carriers and grocery store workers on the front line. We’ve talk to business owners who are caring for their employees health, while also completely changing their business to make masks for healthcare workers (Read the great story of Disc Makers here). The stories about the human spirit and resilience are unending.

We’ve found new ways to connect, especially through video conferencing and advent of virtual happy hours.

At Concentus, we’re trying to do our part: working from home; keeping ourselves healthy; and our parents and children out of harms way. We are here for you and stand ready to help! Please do not hesitate to let us know how we might be able to help you and your family in this tenuous time. We anxiously look forward to the time when we can see each other again, in person.

Stay the Course

‘Stay the Course’ is a mantra I learned early in my investment career. It seems unbelievable to me, but it has been 18 years since I entered the Financial Services industry at Vanguard. In those early days, I remember walking through the cafeteria seeing and greeting the late, great Jack Bogle (1929-2019). A creature of habit, he would appear in the cafeteria daily, with a racquetball racquet hanging out of his gym bag. It was a thrill for me to greet the investing icon – “Good afternoon, Mr. Bogle!” was quickly retorted with “Stay the Course!” It was like clockwork. This idiom has stuck with me throughout my career and is as relevant today as it has ever been.

I often refer to the research and content that Vanguard provides at times like this. Their CEO, Tim Buckley, carries the torch for Jack Bogle’s Stay the Course mentality in recent messages:

First, we stand by our mantra—“stay the course”

An investment plan established during calmer times should not be abandoned in the midst of a market downturn. Let the benefits of diversification play out.

I know how difficult it is to see hard-earned savings diminish, but don’t be tempted to time the markets. It’s a losing strategy. Our studies have shown that chasing returns has historically destroyed 1.5% a year versus staying the course. A message from Vanguards CEO on the Coronavirus

It is not easy to keep your composure during market corrections, and the desire to protect your nest egg is intense! Instincts and human nature often overtake our better, rational thoughts. It is natural to feel nervous, but it is not in your best interest to act on this anxiety. As Vanguard points out, numerous studies show that investors choosing to make changes to their investments, to time the stock market swings, consistently underperform the decision to stay the course. Investors often think that doing nothing is equivalent to not making a decision. That could not be further from the truth. Investors make a conscious choice to stay the course. Additionally, market corrections often present opportunity for tax loss harvesting and rebalancing efforts.

Make no mistake, market timing is very difficult if not impossible for several reasons. You not only have to be right on the decision to sell stocks at the correct moment, but you also must be right a second time, knowing when to buy back in.

In my 30 years in the business, I’ve seen many market storms. Re-pricings are inevitable, sometimes violent, but never predictable. Panic and rash action aren’t your ally. Those who cash out find it impossible to know when to get back in. Indeed, investors that deviate from their long-term plans typically regret it later. A message from Vanguards CEO on the Coronavirus

So, what should an investor do? We all wish we had the ability to anticipate market drops, go to cash, and get back into equities right before the unexpected rally. Unfortunately, I have yet to meet a person who can predict the future. [The emphasis is ours] A message on the markets from our CEO and CIO/

There is a ‘well-known secret’ within the investment community – no one has shown the ability of timing the market year over year. Peter Lynch, former manager of the Fidelity Magellan Fund, who is often referred to as one of the greatest investors, will also tell you that markets cannot be predicted:

I can’t recall ever once having seen the name of a market timer on Forbes’ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.

Of course, no true investment market commentary can be complete without a few quotes from Warren Buffett, which seem to be more relevant than ever:

We have no idea — and never have had — whether the market is going to go up, down, or sideways in the near- or intermediate-term future.

We continue to make more money when snoring than when active.

My favorite time frame is forever.

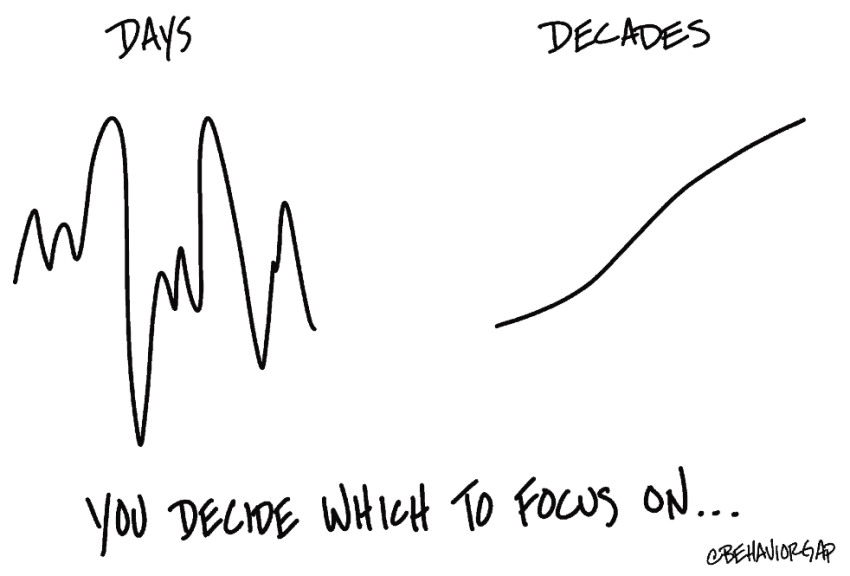

We concur, Warren! We believe that successful investing requires a long view and if given enough time, we can be confident that stock prices rise. The financial plans that we build for clients are based in this premise. We utilize a time-based asset allocation approach that assigns a time horizon to your needs and goals. This, in turn, drives the amount of risk we recommend taking with your investments. Dollars that are invested with a 5-year horizon or more can and should be invested in stocks. It is much more important to invest for decades – not days!

Investment Market Returns for Q1 2020

The 1st quarter of 2020 has witnessed historic stock market declines. The global stock market was down (21%). There were very few places to hide from this tremendous volatility. The US stock market was down (20%), developed international markets were down (23%), emerging stock markets were down nearly (24%), and commodities were down (23%). All risk assets suffered similar fate. Bonds have helped to take the edge off, but there was great dislocation in the bond markets, given the increased credit risk and ever lower interest rates.

We continue to draw your attention to the positive long-term results for all asset classes. To be a successful investor, you must keep a long-term perspective and accept the intra-year gyrations that come with owning risk assets.

We hope this update is helpful to you. As always, we appreciate your continued trust and confidence! We are always available to discuss your portfolio or our strategy.

Want to Learn More?

You should ask a lot of questions before you begin working with a wealth advisor to plan for your future.

We’d love to learn more about you and discuss how we can help you gain the Clarity you need to take control of your financial future.

Reach out to us and let’s start a conversation.

If you have any questions or comments about our advice, let us know.